Key Takeaways

-

Referrals from other professionals, such as wealth managers, is how many professional services providers find their best clients.

-

Strategic partnerships are a key part of getting high-quality referrals from other professionals.

-

Evaluate a potential strategic partner’s attributes, contacts, resources and other traits.

Although there are many ways to build a top-of-the-line professional services practice for the wealthy, the cornerstone approach for most of us remains the classic one: sourcing new prospects and converting them to clients.

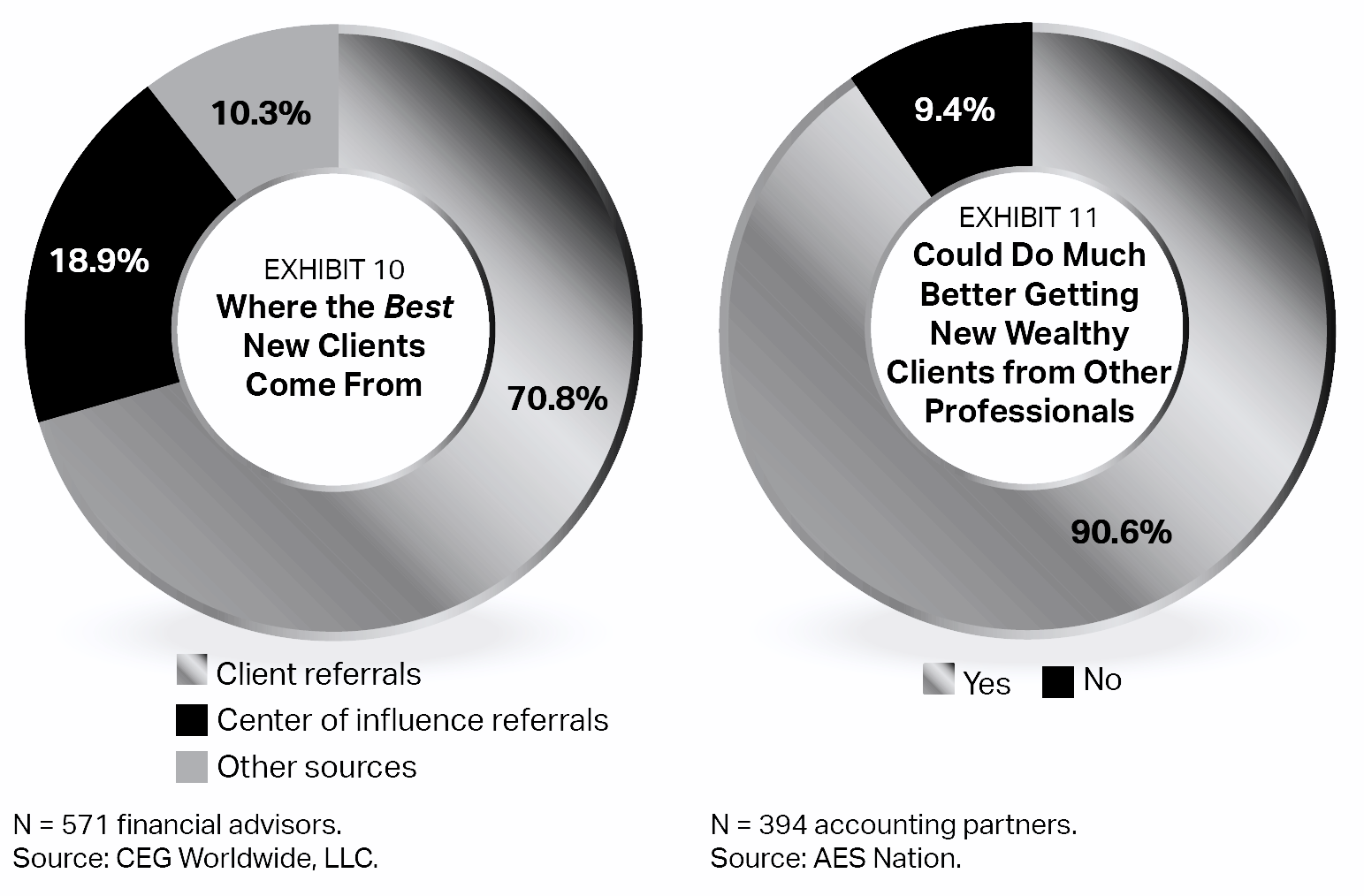

Not that this approach is an easy one, mind you. As just one example, nearly nine out of ten accountants surveyed by AES Nation said it is quite difficult to source new wealthy clients. This same dynamic holds true among attorneys and other specialties, in our experience.

Certainly there are many ways to potentially source high-net-worth clients—including generating client referrals, making presentations at workshops and events, and using social media outlets. Some approaches are more effective than others. But, as evidenced by the research, identifying the most effective method proves challenging for many professionals.

A source of top clients

In our view, the most powerful way to build a highly successful high-net-worth practice is to generate referrals from other professionals.

The reason: While other referral methods might help you attract a large number of clients, referrals from other professionals are how many of us get our best wealthy clients. And as you move up the income scale, you are probably going to find that referrals from other professionals are the optimal way to source wealthy clients (see Exhibit 10). This holds true among financial advisors, too: A full 70.8% of advisors say their top clients came from an introduction made by another financial or legal professional.

The upshot: In order to build an extremely successful practice, you are probably going to have to work with wealthier clients—and being able to consistently source them from other professionals who work with the affluent can be an extremely effective new-client business development approach.

You may know this information already. But it’s a good time to assess how well you’re actually leveraging other professionals for new business opportunities. If you’re like nine out of ten accountants surveyed by AES Nation, you could be doing a better job sourcing new affluent clients from other professionals (see Exhibit 11).

The power of referrals from other professionals

There’s one big reason why referrals from other professionals tend to be so effective in helping attract new wealthy clients: Other professionals working with the wealthy, such as wealth managers, spend their time with their affluent clients addressing matters that overlap with the services and products you likely offer.

Experts in related fields can make influential introductions because these professionals:

- Validate your expertise. When other professionals recommend you and say that you are one of the very best professionals for the job, your ability to get the business increases exponentially.

- Emphasize a personal fit. When other professionals tell their wealthy clients that they will have good rapport with you, your ability to close business dramatically increases.

- The other professionals are emphasizing not only that you can do a great job, but also that you’re a good person to do business with and that the clients will like you.

- Provide impetus to action. When other professionals say to their wealthy clients,

- “You need this accountant’s/attorney’s/investment banker’s expertise, and you need it now,” these clients are much more inclined to engage you, and to do so quickly.

In these situations, the hard-earned, high-quality business and personal relationships other professionals share with their wealthy clients are, to varying degrees, transferred to you.

The secret sauce: strategic partnerships

To make those things happen on a fairly consistent basis, however, it’s important to create strategic partnerships with other professionals who are good potential referral sources.

Such partnerships differ in key ways from the more common strategic relationships that exist between professionals. For example, professionals with whom you have a strategic relationship will possibly refer a new wealthy client to you once in a while. Usually, however, you will be just one of several people the other professional names for their wealthy client to consider. In these situations, it is usually the wealthy client who prompts the other professional to make a referral.

In contrast, strategic partnerships support you directly. These other professionals are exceedingly proactive in finding wealthy clients for you. When they share their wealthy clients with you, they do not even consider anyone else.

There is a systematic process for connecting with other professionals and creating these partnerships that we see works well consistently for a wide variety of professional services providers—and results in a steady stream of new high-net-worth clients. The following actions are instrumental to the approach:

1. Set high but grounded aspirations. Creating a strategic partnership starts with your aspirations. Having notable and often lofty goals tends to foster a virtuous cycle of motivation and actions. It also sets the baseline for measuring success and enables refinement.

2. Advance the agenda. With your goals in place, preparation is essential. You need to put together a plan. Very successful professionals prove to be very good at determining what it is going to take to enable them to achieve their high but grounded aspirations. They often develop an understanding by being astute, lifelong learners and being constructively self-critical.

3. Conduct assessments. The ability to effectively evaluate other professionals is at the very core of partnership success. This commonly involves making extreme efforts to develop a broad and deep understanding of the other professionals you are connecting with (more on this below).

4. Ensure alignment. You must align the other professional’s interests with your own. Aligned interests are usually based on a deep understanding of the other professional’s critical concerns.

5. Measure achievements. To achieve optimal results, you must make sure everything is on track. This entails regularly comparing your results with your aspirations so that if there’s a disconnect, you can make the requisite adjustments.

Assessing the professionals

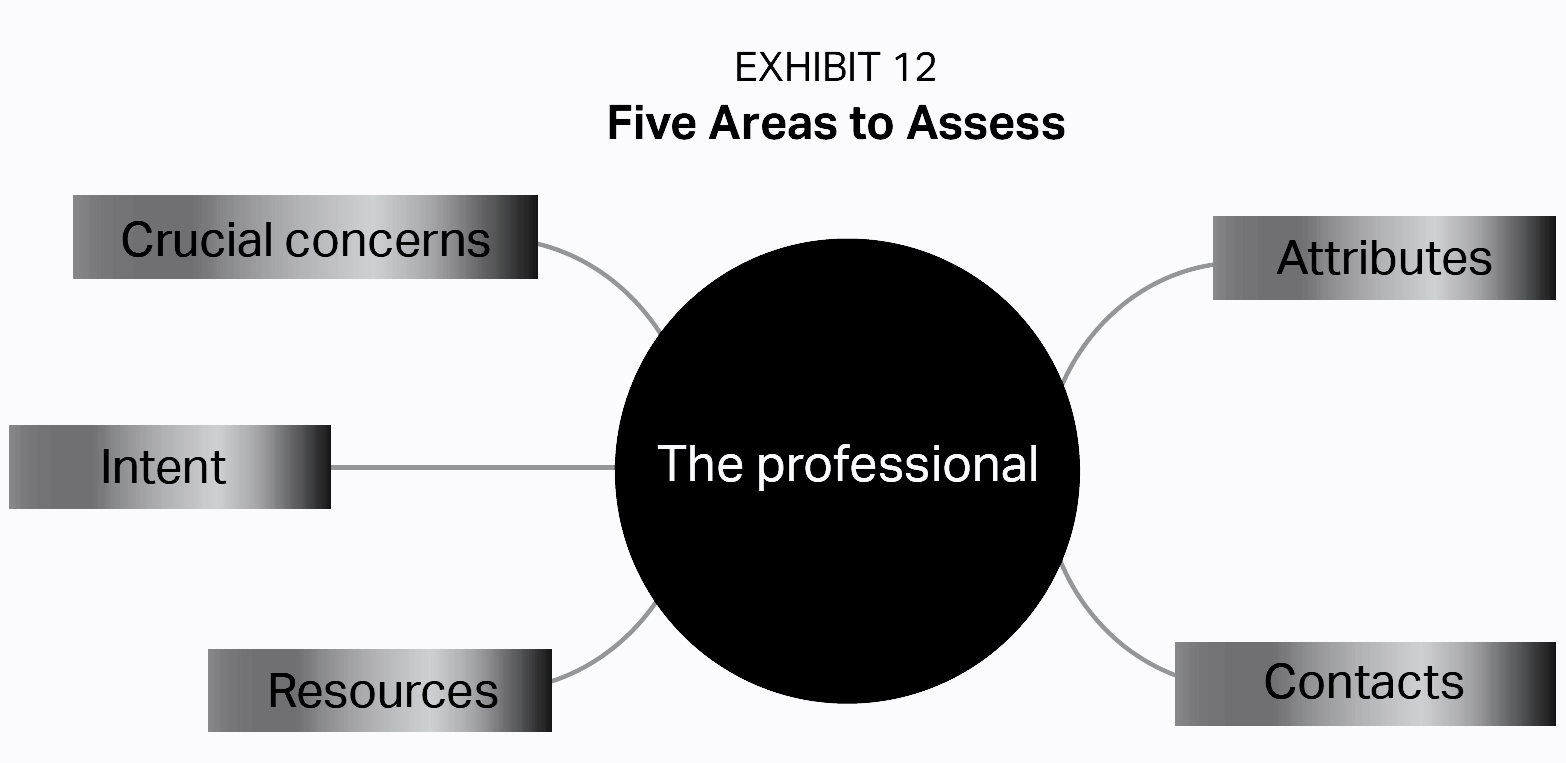

As noted, assessing other professionals you might want to develop partnerships with is a crucial step. Consider evaluating each candidate in five key areas (see Exhibit 12).

1. Attributes

Attributes are the central and often defining characteristics of the person. Look to address the following attributes:

- Demographics (personal factors, years in business, wealth).

- Professional situation (technical expertise and specific competencies, strengths and weaknesses, a comprehensive understanding of their business model).

To ensure a solid and ongoing alignment of interests, you must understand the other professional’s situation. You will also need to be keenly aware of their goals, as well as how the professional achieves these goals based on their particular business model.

2. Contacts

These are the people the other professional knows and can access. There are many components to assess here, the most pressing and informative of which are:

- Nature of contacts (the affluent with whom they do business, the types of affluent clients they have).

- Source of contacts (through business connections, through family connections, through social connections).

- Strength of contacts (support they have provided, support they have obtained, any obligations they owe and are owed).

- Connector capabilities (extended contacts—second and third spheres beyond direct contacts; the quality of these extended relationships).

3. Resources

Resources are the “assets” and means at the other professional’s disposal, beyond the people they know and can influence.

Access to resources (types of resources that are available to the professional, form of control with respect to these resources, degree of applicability and leveragability, and how these resources can prove beneficial).

It is not only whom the other professional knows, but also the professional’s ability to deliver other resources that can prove quite useful in enabling you to acquire new affluent clients. The other professional’s firm’s marketing capabilities, for example, can be very helpful to all parties in accessing new wealthy clients.

4. Intent

This refers to the other professional’s preferences, needs and wants as they translate into interim objectives, which feed into larger goals. These various goals and objectives are evidenced in their needs and wants, so they must be taken into account. There are three categories of goals:

- Financial goals (the other professional’s financial end goal, financial goals for various business initiatives, the gaps between current status and goals).

- Strategic business goals (business stature and positioning, explicit planned and tactical objectives including methodologies and operational considerations, the principal obstacles to achieving strategic business goals).

- Personal goals (nonfinancial goals for their family and themselves; any philanthropic aims and particular charitable activities).

Other professionals with whom you’re considering a strategic partnership should have ambitious financial end goals. It is quite helpful if they are “hungry” and very keen on becoming significantly more successful.

5. Crucial concerns

These are the dominant and persuasive issues and interests the other professional is presently dealing with. You need to know the following:

- Issues and matters that are top of mind to the professional (concerns that are dramatically impacting decision-making, concerns that affect their ability to focus, respond and follow through).

Conclusion

Ultimately, we believe that if you want to build a business that focuses on serving the affluent—or transition your practice into one that serves clients who have greater wealth than the ones you currently work with—one of the best ways to pursue that goal is to build relationships with other professionals who can serve as referral sources of ideal prospects.

0 Comments