Key Takeaways

- An exit plan should be closely examined to see whether it’s on track.

- How confident are you that you’re protected from frivolous lawsuits?

- Retirement plans can have multiple goals for business owners.

As a successful entrepreneur, you’ve probably engaged in a considerable amount of business planning to help you get your company and your team moving in the right direction. But how confident are you that the planning you’ve done is still on track to deliver the results you expect, want and need?

If you’re even the least bit uncertain, it may be time for a stress test.

Stress testing is a process that carefully examines your business and wealth planning efforts and “puts them through their paces” to determine how the strategies you have in place are likely to hold up in various scenarios. Ultimately, stress testing can help you see if your planning is likely to lead to the outcomes you desire.

We’ve seen stress testing used by the self-made Super Rich (those with a net worth of $500 million or more) for years. But it’s become increasingly common among less affluent entrepreneurs as well—to assess both personal wealth planning and business strategies (and the relationship between those two areas).

Here’s why you might want to bring stress testing into your business and your life.

A focus on results

For starters, it’s important to realize that stress testing is focused on results. Some entrepreneurs—as well as some legal and financial advisors—mistakenly believe that it’s about the specific financial products or legal tools being used. But while stress testing may uncover opportunities where superior tools and products could be implemented, its main purpose is to determine whether there is a serious disconnect between what entrepreneurs are aiming to achieve and the results they are likely to get using certain strategies and planning approaches.

Also keep in mind that when it comes to stress testing, a key factor—maybe the most important factor—is the human element. This is the personal and emotional component of wealth planning for you personally or for your business. It includes everyone and everything that is important to you, as well as everyone and everything that could be affected by the wealth planning.

A professional who conducts a stress test will focus intensely on those aspects of your life and how well your planning is set up to meet your unique agenda. The specific tools available to these professionals are less important—mainly because high level tools and expertise have become easy to access. For example, we find that there are now many attorneys who can use certain trusts that freeze the value of a business to mitigate future estate taxes. Likewise, there are quite a few wealth managers who can offer the complete array of qualified retirement plans to a business owner.

For the best professionals, it is not the toolkits they have that differentiate them and allow them to conduct effective stress tests. Instead, we find it’s their skill at identifying the most appropriate tools and strategies for helping you achieve your specific personal and entrepreneurial agendas.

Three areas to stress test

Stress testing can be extremely narrow and focused—addressing, for example, one particular component of wealth planning such as business succession planning. Or it can be much more comprehensive, assessing multiple planning areas and identifying synergies (or inefficiencies and overlap).

When it comes to stress testing your wealth planning with regard to yourself and your business, there may be a number of areas to evaluate given the many moving parts involved. That said, our experience tells us that there are three areas that tend to be of particular interest to successful entrepreneurs:

- Exit planning

- Asset protection planning

- Retirement planning

1. Exit planning

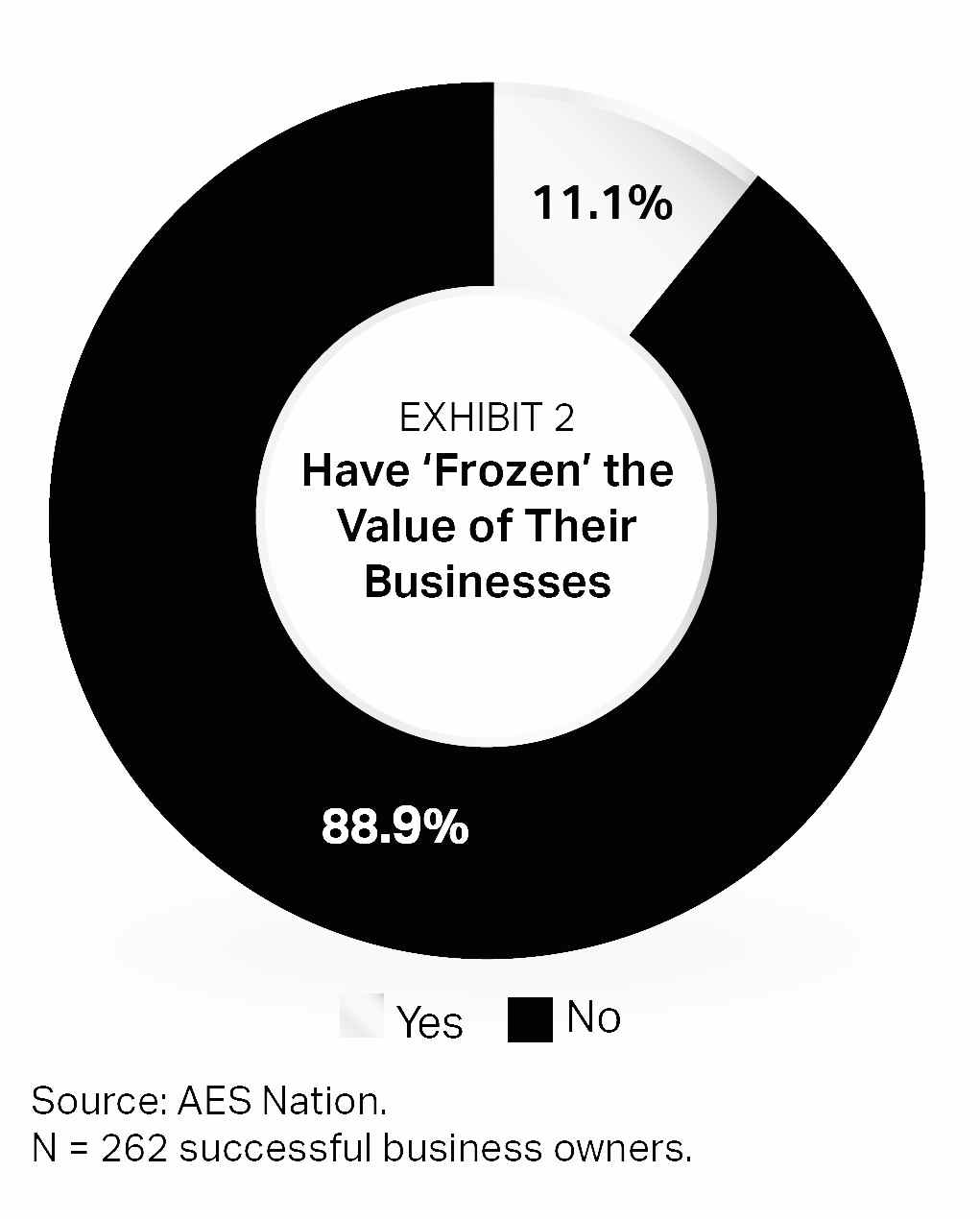

Minimizing future estate taxes can be a major component of exit planning. However, only about one in ten successful entrepreneurs has acted to “freeze” the value of the business for this purpose, according to research by AES Nation (see Exhibit 2). Such a move dovetails with estate planning.

This doesn’t mean implementing a plan to freeze the value of your business is necessarily the right move for you. But the research suggests that many entrepreneurs have not looked into a step that is potentially helpful. If you are considering the sale of your company, skillfully executed stress testing can identify ways to walk away with more wealth from the sale—money that can go to family instead of to the government.

2. Asset protection planning

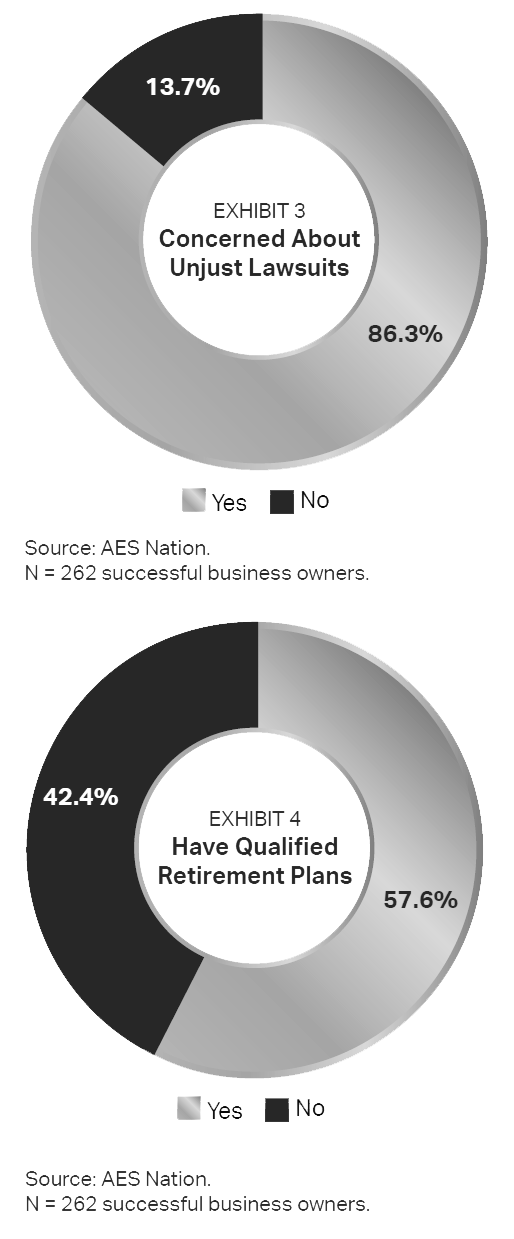

AES Nation research also found that more than 85% of successful business owners are concerned about being involved in unjust lawsuits (see Exhibit 3). The obvious question:

What are they doing about it, and are they likely to get the results they are looking for through their actions?

We find that successful business owners often do take steps to protect their wealth but that they generally don’t cover all the bases. For example, ask yourself:

- Is the indemnification language in my corporate documents as strong as I want it to be?

- Is my commercial insurance coverage adequate?

- Do I have directors and officers insurance—and does it effectively address the risks?

Another matter to possibly consider is how you are structuring your business interests. For example, some entrepreneurs with multiple companies have ownership in each—when a smarter approach could be to set up a holding company.

The upshot: Stress testing can help determine whether your wealth is well insulated, taking into account your risk tolerances and concerns.

3. Retirement planning

Nearly three out of five successful business owners have qualified retirement plans, according to AES Nation (see Exhibit 4). For some companies, they are not viable. In some cases, there are certain types of qualified retirement plans that would be very appropriate but were never offered to the business owners.

In stress testing a retirement plan, the first consideration should be the intended outcome or outcomes. Some business owners want to use a retirement plan as a way to help attract and retain top talent. Others are looking to lower taxes.

It is then possible to examine how likely an existing plan is to achieve that goal—or to identify various plans that match up especially well with the intended outcomes.

Do you need to stress test?

Depending on circumstances, stress testing can be expensive. Even if the costs are minimal, a stress test requires time and effort on your part. So should you stress test at all?

Consider these questions to help you determine your next move:

- When did you last evaluate how you structured ownership of your company, with an eye to transferring the business and protecting yourself in case of a lawsuit?

- When was the last time you reviewed the indemnification language in your corporate documents?

- When was the last time you reviewed the financial and legal steps you would take if important personnel—including partners—died or became disabled?

If you’re not sure of the answers—or if it’s been years since you last looked at these issues— it may be time to conduct a stress test on one or more aspects of your business. Stress testing often uncovers that wealth planning done in the past, which was ideal at that time, has become imperfect as a company has grown. Business success can actually create gaps in the existing business planning. What’s more, your goals and needs as an entrepreneur can change over time, and stress tests can spot where planning is no longer in sync with current agendas.

Some other questions you might consider:

- With changes in tax laws and regulations in recent years, are you taking full advantage of all the ways you can legally reduce your corporate and personal tax bills?

- Are you making use of all the corporate risk mitigation strategies currently available to your business?

- Are you getting the most benefit from qualified and nonqualified retirement plans?

We find that many accomplished entrepreneurs turn to stress testing to make sure they are not missing opportunities. It is not about correcting mistakes as much as it is about taking full advantage of planning that reflects the current environment and new options that are available.

Ultimately, it’s probably worth considering stress testing for at least some key areas of

your business. Whether it’s a question of plans being up to date or making sure all available financial and legal options are considered, stress testing aims to give you the clarity you need to move forward with purpose and confidence so you can build a great business— and live a life of significance.

0 Comments