Key Takeaways

- Term life insurance is all about the death benefit—and there’s more flexibility to these policies than you might think.

- Whole life is a type of permanent life insurance.

- Multiple forms of universal life insurance exist that carry their own pros and cons.

Life insurance—it’s one of those categories of wealth management that’s commonly viewed as plain vanilla and a bit dull, or even as one of life’s big annoyances. (Anyone who has seen the movie Groundhog Day will likely remember insurance salesman “Needle-Nose” Ned.)

But, of course, life insurance can be vitally important to achieving goals such as providing for your family and ensuring tax-efficient estate planning that builds and protects wealth.

What’s more, we find that many people don’t really understand the foundational facts of life insurance—neither the policies they currently have nor other types of life insurance out there that could potentially be beneficial to them or people they care about.

With that in mind, it makes sense to get up to speed on some fundamentals of life insurance—the different types and how they work—given how valuable these policies can be to your future and the future of your loved ones.

Two main types

Life insurance can serve many more purposes than people generally assume. Despite its many permutations, life insurance at its core can be a versatile financial product used to protect the wealth of heirs, ensure the continuity of a business, facilitate charitable giving and even generate a financial return for policyholders.

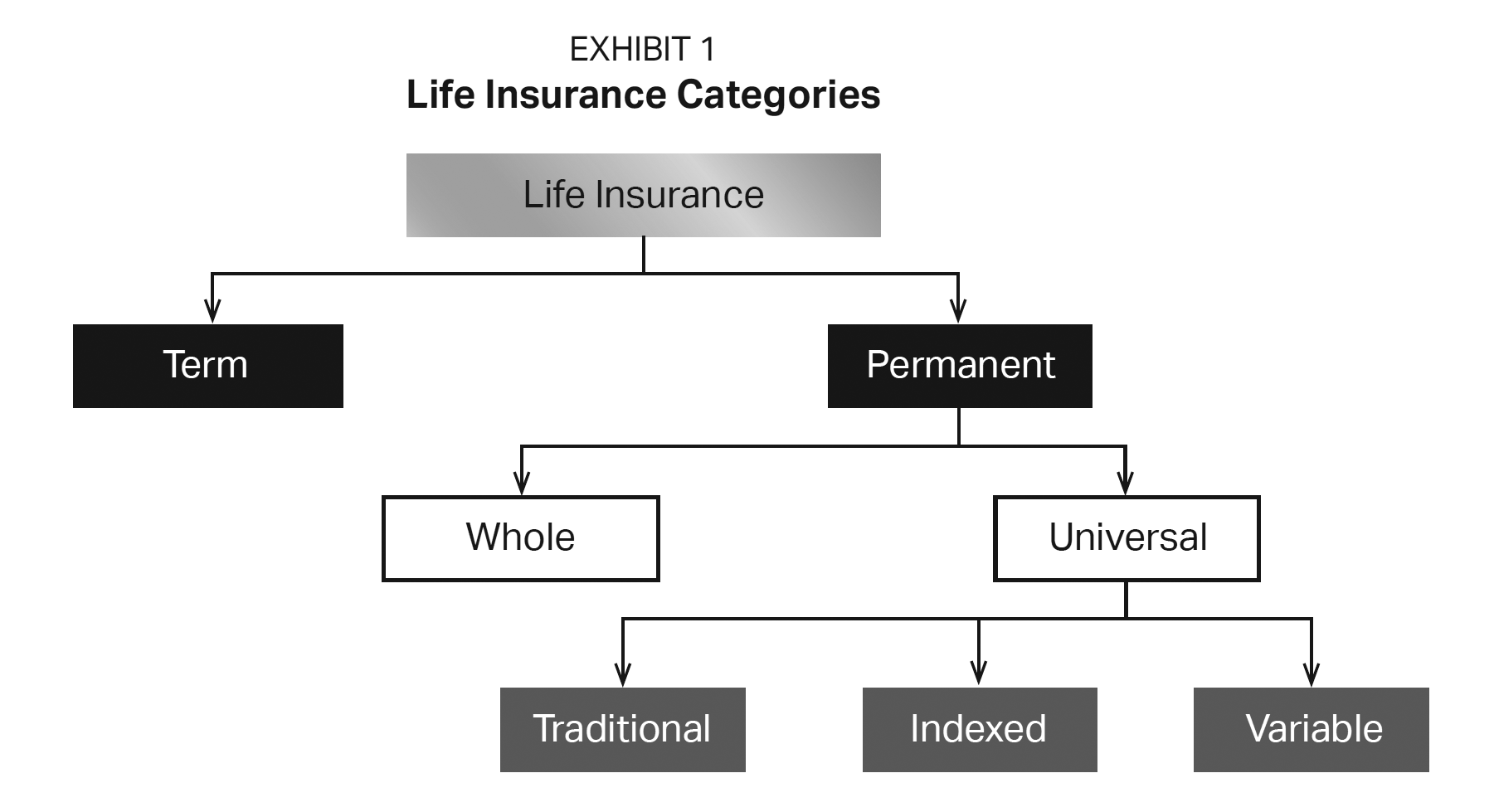

But let’s face it: The life insurance landscape is an often-confusing mix of options with names and abbreviations that come across as “alphabet soup.” A useful first step is understanding the principal differences among the types of life insurance. As seen in Exhibit 1, the two main categories are term insurance and permanent insurance (with various iterations in the “permanent” category).

Overview of key characteristics

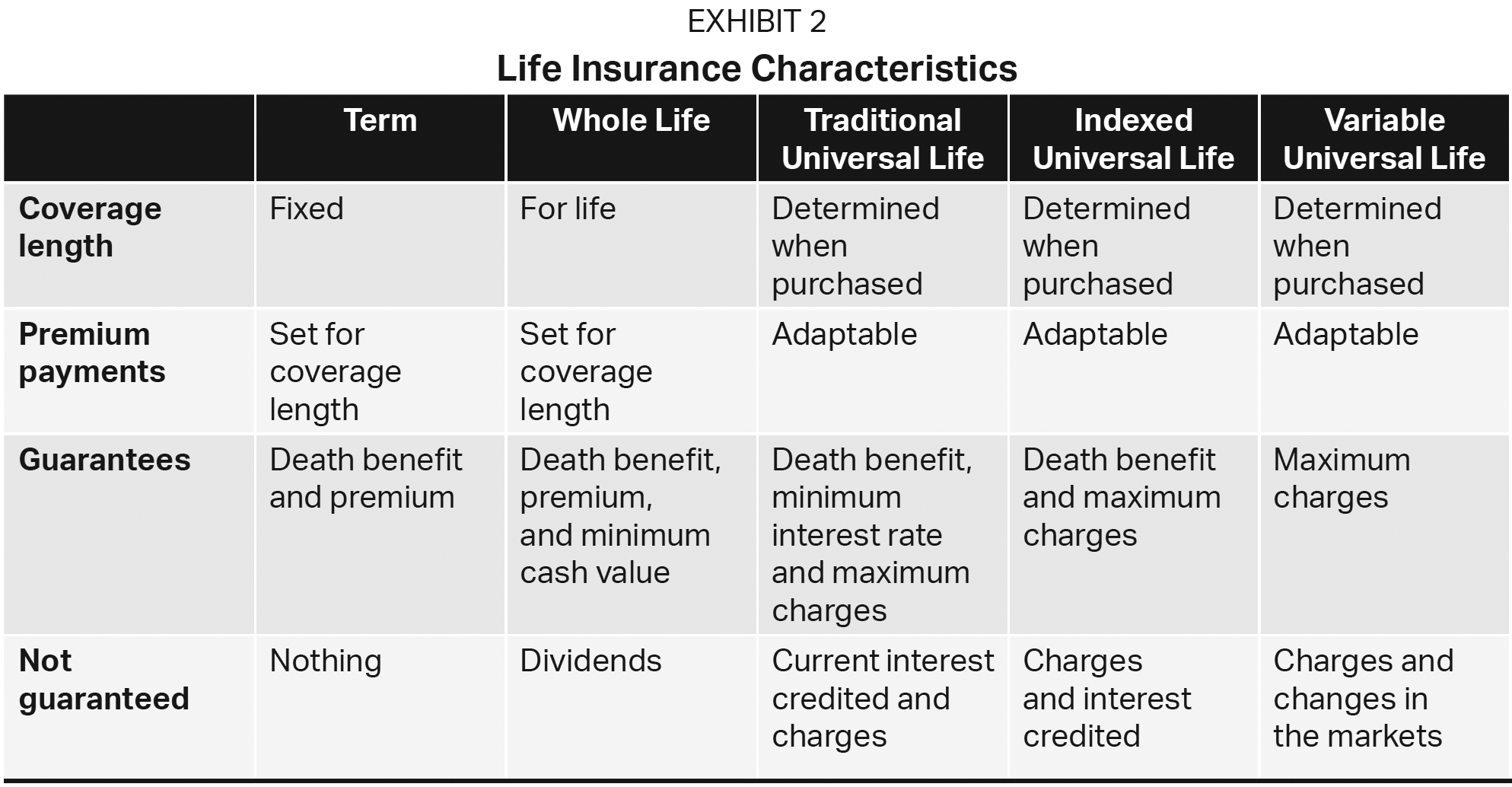

The various types of life insurance have different characteristics (see Exhibit 2). One foundational difference between the two core types of life insurance—term and permanent—is that the premiums you pay for a permanent life insurance policy fund both the death benefit (the money your family receives when you die) and a cash value account. The money in the cash value account grows tax deferred—that is, you don’t pay taxes on the growth of the money in the account while those funds are in the account.* However, if you take out a loan from the cash value that you don’t pay back, the loan amount (and interest) gets deducted from the death benefit if you pass away.

Let’s explore the major types and subcategories.

Term life insurance

This is the first thing many people think of when they hear the words “life insurance.” With a term life policy, you are buying a specified death benefit—known as the face amount—for a limited, defined period of time. You choose, from various options offered, how long the term life insurance policy will stay in effect. For example, the term life insurance policy might be for ten or 20 years (or even longer). But it could also be set up to stay in effect until a particular date, such as when you turn 70 or 80.

In most cases, the cost of the term life insurance is determined and locked in when you buy the policy. The premium payments from then on are fixed and guaranteed for the duration. These are referred to as level term life insurance policies. The premiums stay the same throughout, as does the death benefit. That said, some term life policies allow you to increase or decrease the size of the death benefit. If you do so, the cost of the term life insurance policy will change too.

Other, more complex flavors of term life exist, however. One example is a renewable policy. You buy a term life insurance policy for a certain number of years. When the policy duration ends, you can renew without having to demonstrate whether you’re still healthy enough to be insurable. The big caveat, as you can probably guess, is that the cost of the policy rises—often substantially—when you re-up.

Another type of term life is called return of premium. It gives you back the cost of the policy if you survive for a predetermined amount of time. You also may be able to reenter the policy and pay a lower premium at the time of renewal (provided you meet certain insurability criteria). Return of premium insurance may be significantly more expensive than the other types of term policies.

Important: Term life insurance policies are purchased strictly to provide a death benefit—they don’t have a cash value account, as do permanent life insurance policies. That said, term life insurance policies may include a convertibility provision that allows you to switch to a permanent policy without having to show insurability.

Whole life insurance

Our first stop in the permanent life insurance category is whole life insurance—which, as the name suggests, is for the entire life of the insured. You pay premiums that have been determined to keep the policy “in force” for your lifetime. These premium payments stay the same each year, with some of the payments put into a cash value account. The insurance company manages the money in the cash value account and guarantees a minimum interest rate.

You can borrow money from the cash value account (you have to pay interest, of course) and can add optional riders and benefits to your policy. Riders are additional features that can be bought and added to a policy to essentially customize it to address a need or want. One example: a rider that can provide money to use during treatment you receive if you become critically ill. That said, riders typically limit the types and amounts of benefits they offer, and their cost depends on the specific rider and the company offering it. For example, a rider may stipulate that you need to die from a very specific cause in order for it to pay out. Comparing a rider’s cost with the potential cost of the financial risk can be a smart step.

Bonus: Some whole life insurance policies let you share in any distributions of surplus funds the insurer decides to make.

Traditional universal life insurance

Another permanent life insurance option, traditional universal life insurance, has many of the same characteristics as whole life insurance. The big difference is that these policies are more adjustable—you can change the amount and duration of your premiums and still ensure coverage for your entire life. (However, there must be money in the cash value account to do this.)

Each month, the money in the cash value account is credited with interest. The insurance company decides on the interest rate, but there can be a guaranteed minimum interest rate.

The death benefit can either be set in advance or increase annually based on the amount of money in the cash value account or on the paid premiums. In addition, loans can be taken out of the cash value account and riders can be attached to the policy.

Indexed universal life insurance

This is a variation on traditional universal life insurance. It works largely the same way, but the interest rate is determined by an equity market benchmark (the S&P 500, for example). Because it’s tied to the performance of a stock index that will fluctuate in value, an indexed policy may potentially generate greater returns than a traditional universal life insurance policy that comes with a fixed interest rate set by the insurance company. Of course, the opposite is also true—an indexed policy could experience lower returns than those generated by traditional universal life.

Variable universal life insurance

This is a third iteration of universal life insurance. Instead of letting the insurance company or an index determine the performance of your cash value account, you can choose from a list of investment subaccounts to which the money in your account will be allocated.*

This exposure to various areas of the financial markets can mean you face risks such as significant fluctuations in the value of the account, and the potential for both high returns and substantial losses depending on the performance of the subaccounts. Experiencing large enough losses in value may require you to make larger premium payments to cover the cost of the insurance, rebuild your cash value and maintain the policy. Another consideration: Fees for this type of policy tend to be higher than for other types, because it involves both insurance and investment management fees.

Navigating the landscape

This is a look at some of the key forms of life insurance that we find most people tend to consider. It’s certainly not a comprehensive review, and you may find yourself examining other types such as survivorship life, group life and supplemental life that go beyond the foundational offerings.

Given all the options, it generally makes sense to work with a professional you trust when weighing different types of insurance and selecting specific policies and insurers to use. As you’re probably aware, the policy documents themselves tend to be obscure and opaque to most people—and they can quickly become baffling when riders and other add-ons are introduced.

But remember: Even when working with a trusted professional, always concentrate on what you are aiming to accomplish by purchasing life insurance. As noted, life insurance can be very versatile. Just be sure that the insurance you go with is designed to help you effectively pursue your specific agenda.

* Disclosure: Tax laws are subject to change, which may affect how any given strategy may perform. Always consult with a tax advisor.

*Disclosure: Investments carry risk of loss, and returns are subject to the performance of investment vehicles.

0 Comments