Key Takeaways

- Tax-loss harvesting can help offset taxable capital gains and taxable income.

- For the strategy to work, certain rules—such as the wash sale rule—must be followed.

- It may be appropriate to consider tax-loss harvesting as part of a broader plan for mitigating taxes.

With that in mind, it’s worth taking a fresh look at this tax mitigation strategy that has become important to many investors who share the goal of sending less of their wealth to Uncle Sam each year.

A versatile strategy

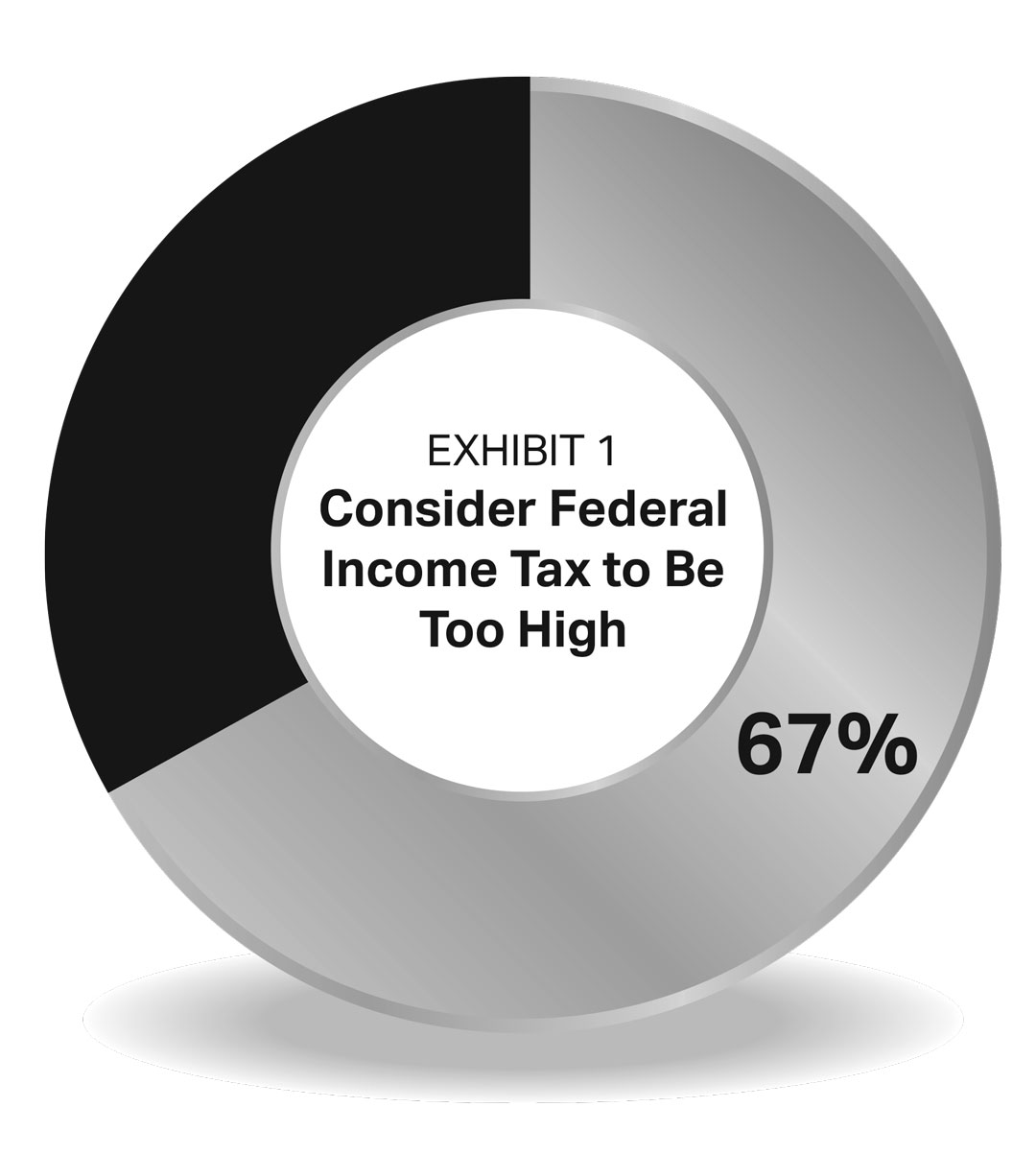

Mitigating taxes is a major goal of many affluent investors, and long has been. In conversations with financial advisors, for example, CEG Worldwide consistently finds tax mitigation to be among high-net-worth investors’ top five financial concerns. Likewise, about two-thirds of people (67%) consider their federal income tax to be too high (see Exhibit 1), according to a 2024 UChicago Harris/AP-NORC nationwide poll of 1,024 adults.

Tax-loss harvesting is designed to address those concerns. As you likely know, tax-loss harvesting involves incurring losses in a taxable investment account by selling one or more securities (stocks, mutual funds and ETFs are some examples) that have fallen in value to below the price you initially paid for them. By realizing that capital loss, you may offset capital gains that have been generated by other securities in the portfolio—for example, appreciated assets that you’ve sold at a profit or capital gains distributions made by a mutual fund.

Ideally, your harvested losses would cancel out any gains on which you’d be taxed. Additionally, the rules enable you to use those losses beyond the immediate gains. Say that your realized capital losses are greater than the capital gains in your portfolio this year. In that case, you can use as much as $3,000 of those losses to offset ordinary taxable income for the year.

As an added bonus, it’s not a “use it or lose it” situation. If your realized losses exceed both the capital gains and the $3,000 income limit for the current year, you can carry those losses forward—and use them to offset future taxable profits and income. So if you wind up seeing a big tax bill next year, you could have offsets at the ready.

The effectiveness of tax-loss harvesting will depend on many factors—including each investor’s circumstances and when the harvesting occurs. And while there are no guarantees, one study by academics at MIT and Chapman University suggested that tax-loss harvesting might boost a large-cap stock portfolio’s returns by as much as 1.1% per year.

Being smart with TLH

As with any investment strategy, tax-loss harvesting should be used in ways that reflect each investor’s situation and needs in order to generate the optimal benefits. And despite its benefits, tax-loss harvesting has risks and simply doesn’t make sense for everyone.

Consider some key issues and risks before seeking to harvest investment losses.

1. Missing out on rapid gains

Investors often want to do a lot of tax-loss harvesting after a particular market sector, or even the market as a whole, has been nosediving. During corrections and bear markets, it’s easy to believe more negative results are ahead and to therefore book losses. But rebounds have the potential to occur quickly, and the magnitude of those moves can be strong. Ditching investments to sidestep taxes can cause you to miss out on upside if those investments surge. And as you’ll see, you can’t simply sell a stock one day and rebuy it the next if you want the benefits of tax-loss harvesting.

2. Replacing the assets you sell

After you sell an investment at a loss in hopes of offsetting taxable gains, your next move is an important one. If you want to continue to have exposure to the type of asset you just sold—and, as noted above, that might make good sense—one move would be to buy a similar investment. Example: replacing an S&P 500 ETF with another ETF that tracks that same index.

But here’s where you come face-to-face with what’s called the wash sale rule, which says that if you sell a security at a loss and buy the same or a similar security within 30 days before or after the sale, you can’t claim the loss on your tax return. What’s more, the wash sale extends to other accounts too—so if you sell a stock in a taxable account then buy the same stock right away in a retirement account, you still violate the wash sale rule.

The good news: You may be able to replace the sold security with one that is different enough to satisfy the IRS. For example, if you sell a fund that focuses on large-cap stocks, you could consider buying another large-cap stock fund that is offered by a different company and that tracks a different benchmark.

3. Incurring a larger tax bill in the future

It’s possible that tax-loss harvesting could end up costing you down the road. If you regularly realize losses on securities you rebuy after the wash sale period, you may lower the overall cost basis of your investments. If those investments go on to generate strong returns over time—or if capital gains tax rates rise—you could potentially find yourself with a higher tax bill than you anticipated.

4. Overdoing it

The thought of using tax losses to reduce your tax bill might sound wonderful, but it’s entirely possible to let tax-loss harvesting get out of hand and end up diluting its potential benefits. For one, transactions (such as selling securities, buying replacements and possibly even rebuying the initial securities) likely come with costs. Getting overzealous with buying and selling can potentially erode a chunk of tax savings you might generate.

In fact, research suggests that loss harvesting shouldn’t be treated the same as playing the daily Wordle or Sudoku. Example: One study, co-authored by a research economist for the International Monetary Fund, showed that conducting tax-loss harvesting on a daily basis doesn’t benefit investors unless the security being sold is down 15% or more and the plan is to rebuy the security after the wash sale rule period is over. Similarly, it found that monthly loss harvesting is best done with securities that are down at least 10% and expected to be repurchased later. Overall, the study concludes that “harvesting on a daily frequency offers virtually no advantages to harvesting monthly.”

5. Focusing on the most impactful investments

A vast array of securities can be sold at a loss for use against gains. However, some evidence suggests that certain asset types may offer more overall tax advantages than others. For example, a portfolio of individual stocks that is harvested for losses when certain conditions are met can produce more profit than will a portfolio of ETFs that does tax-loss harvesting, according to research published in The Journal of Beta Investment Strategies.

That’s not to say only individual stocks should be considered for tax-loss harvesting, of course—just that different securities have the potential to generate better outcomes in certain instances.

Only part of the equation

Tax-loss harvesting is a tool that investors with taxable investment accounts should at least look into. The potential to reduce your taxable capital gains and taxable income—and do so for multiple years, possibly—simply by selling certain beaten-down assets makes tax-loss harvesting an attractive solution in some cases.

That said, tax-loss harvesting is just one possible move to consider when looking to mitigate taxes. Other strategies exist, such converting a traditional IRA or 401(k) to a Roth IRA, taking advantage of tax-exempt or tax-managed investments, and implementing a charitable giving strategy with tax benefits.

The upshot: Don’t treat tax-loss harvesting like it’s a magic bullet. Examine and weigh your tax mitigation options—including consulting with a trusted advisor for guidance about the benefits and the risks—and see whether tax-loss harvesting may fit into a comprehensive plan for keeping more of what you make.

Disclosure: Tax laws are subject to change, which may affect how any given strategy may perform. Always consult with a tax advisor.

0 Comments