Key Takeaways

- Entrepreneurs often overvalue their businesses, which can lead to problems.

- There are at least six approaches to formal business valuation.

- Consider enlisting the help of a valuation specialist.

Do you know—really know—what your business is worth?

There’s a good chance that the answer is “no.” These days, many entrepreneurs are so focused on running their companies that they don’t have a good handle on big-picture issues like valuation. But even if you’re highly confident you know the number, a formal business valuation might be eye-opening.

Obviously it makes sense to have a formal business valuation done if you’re planning to sell your business, or even if you’re just thinking about doing so in the coming years. Formal valuations are often very useful in helping all parties involved by providing, at the very least, a solid starting point for negotiations.

However, you might want to value your business even if you have no intention of selling. That’s because a formal valuation can be an important step to take in many circumstances—for example, if you are looking for credit, determining the ownership percentages of partners or going through a divorce. Also, just because you’re not planning to sell doesn’t mean you won’t get unsolicited offers from potential buyers— and if you do, it’s smart to be aware of your company’s valuation right from the start of those interactions.

Regardless of why you have a valuation done, you might find that the end result surprises you.

Is it worth what you think?

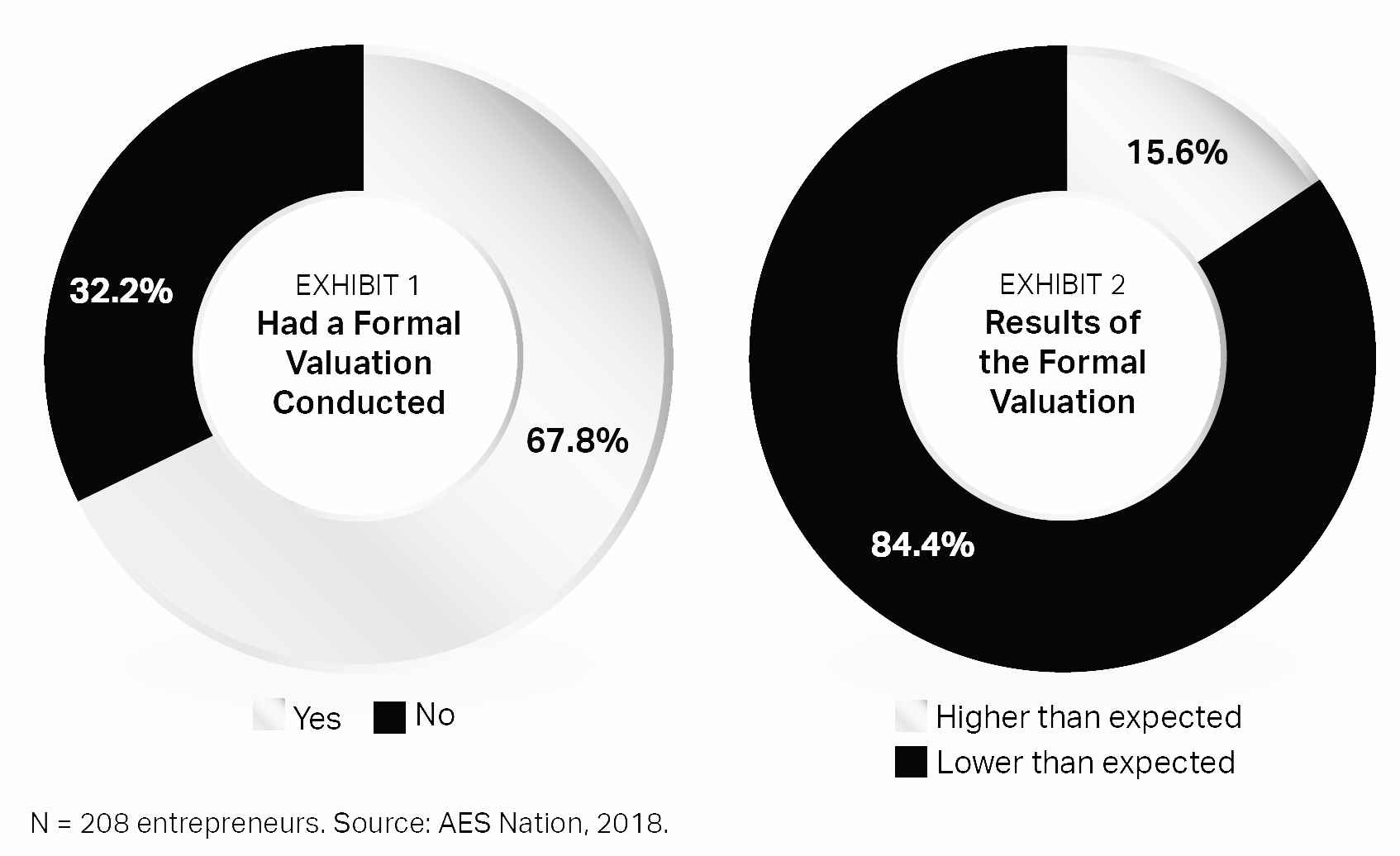

According to a survey by AES Nation of 208 successful business owners looking to sell their business within five years, about 70% have had a formal valuation conducted within the previous three years (see Exhibit 1). As business owners get closer to deciding to sell their company, we find that they tend to be more likely to have it valued. That makes sense, given that a formal business valuation is often required when selling a business.

We see that when a formal valuation is done, the results are often unexpected. Consider that nearly 85% of the entrepreneurs surveyed by AES Nation said the valuation came in lower than they anticipated (see Exhibit 2). These entrepreneurs clearly had overestimated their company’s worth.

That’s not terribly surprising, of course, given how hard they likely worked to build their business and how emotionally invested they are in it. Still, this finding should give you pause as an entrepreneur. If your perception of your company’s value is too high, you might end up rejecting some solid offers from potential buyers. In fact, if your determination of the value of your company is significantly greater than the value determined through a formal valuation, there might not be many buyers taking interest in your business at all.

It’s worth noting that 15% of the entrepreneurs surveyed by AES Nation were surprised by the formal valuation because it came in higher than they expected. That might sound like a pleasant surprise, but there are potential problems when you undervalue your company. For example, you might take a low offer that is clearly not in your best financial interests.

The most interesting finding, to us, was that not one of the entrepreneurs said the valuation was “just right.” This strongly suggests that a formal valuation is an important step in aligning perception and reality.

Important: Keep in mind that a formal valuation is not necessarily the price your company will ultimately sell for. Instead, this valuation is generally the starting point for negotiations— and it can be helpful in justifying a price.

Know the methods

So where to begin? There are a number of business valuation methods that entrepreneurs should be aware of. The following is a brief overview of six commonly used business valuation methods.

Market value company valuation

This is a comparison of your business with the sale price of similar businesses. Comparative data is required. In some situations, such as those involving the sale of relatively small companies, such information is not available or may not be very informative.

The market value method can be a good starting point in helping determine what your company is worth, and it helps start the discussions about selling your company. However, it can be imprecise and is often quite subjective. Therefore, when this approach is used, your and your team’s ability to negotiate becomes especially important.

Asset-based company valuation

This is a balance sheet approach that calculates the company’s book value—its total assets minus the total liabilities of the company.

ROI-based company valuation

A buyer considering their return on investment (ROI) is calculating the potential payout from acquiring your company. Issues that buyers are likely to consider include:

- How long will it be until the investment is recovered?

- What is the probable total payout from the investment?

- Are there other opportunities that would provide a better ROI?

Discounted cash flows

Here, the projected cash flows of your company are estimated and are then discounted to the present. Deciding on the best discount rate can sometimes be a nuanced and tricky process.

Multiple of earnings

The valuation is based on multiplying current revenues by a predetermined number. The multiplier is a function of the industry the company is in, the overall economic environment, the growth rate of the company and other factors.

Capitalization of earnings

This is a more extensive formulaic approach that takes into account cash flows and annual ROI. This valuation method is a snapshot in which the presumption is straight- line continuity. Therefore, it is most often used with very stable companies generating highly consistent results from year to year.

Selecting the most appropriate valuation method

With six valuation methods to choose from, which one is best? The answer, of course, is “it depends.”

The right approach for you will depend on a variety of factors (such as the industry you are in and the size of your company). Ultimately, valuing companies is part science and part art. For example, a valuation method that might have been appropriate for your business in the past might not be viable now—if, say, your company has changed course in some fundamental way. The growth and size of your company, the changing dynamics of your industry, the stability of your company, and other factors all can play a role in determining the “best” valuation approach.

What’s more, you might end up wanting to sample multiple valuation methods to gain deep enough insights into which particular approach makes the most sense given your situation and the goals you’re looking to achieve through the sale of your business.

For these reasons (and others), it’s often helpful to bring aboard a valuation specialist— someone who has the requisite skills to value your company and who doesn’t have any emotional attachment to your business. Such a specialist is likely to deliver a clearheaded, objective valuation and assessment.

Armed with such an assessment, you can take steps to increase your business’s value (if necessary) and negotiate wisely and shrewdly to help you walk away with a better deal in the end.

Conclusion

It’s important for entrepreneurs to work not just “in” the business—the daily and

weekly duties—but also “on” the business by thinking big picture and long term about issues such as valuation. In

our experience, business owners who can do both (or, more likely, enlist expertise

to help them do both) tend to generate better outcomes— today, next year and even decades from now.

0 Comments