Key Takeaways

- Failures should be autopsied—examined to learn what went wrong so you don’t repeat the same mistakes.

- Be appropriately hard on yourself when sizing up your mistakes—without sabotaging yourself.

- Do not rush the process—take your time and be thorough.

Let’s face it: As you pursue your goals in life, chances are high that you’re going to fail at some point along the way. There are going to be business ventures that crash and burn. There will be workplace or volunteer initiatives that don’t live up to their promise. And there are people you are going to depend on who will let you down.

What’s more, the higher you set your sights, the more likely you are to fail. In fact, it’s probable that the failures will be grander because your aspirations and efforts are going to be grandiose and intense.

But here’s the thing: How you react to unavoidable stumbles and blowups can make all the difference in achieving tremendous success in the end.

Example: We discovered that most self-made billionaires are experts at using failures and losses to improve themselves, their agendas and their future results. Indeed, nearly every person we know who possesses significant wealth has a story—often several—about the bad business decisions they made, the bad investments they owned and the bad people they chose to surround themselves with. But they have taken steps to learn from those decisions and avoid them the next time around—helping them to increase their success and their wealth.

This stands in stark contrast to how most people deal with failure. When initiatives turn into train wrecks or entire businesses crumble, most people hunker down and retreat—letting these situations get the best of them. Some people will metaphorically hide under their blanket—and a few will even do so literally.

Many will ruminate on the perceived disaster and, in so doing, magnify their anxieties and become depressed. That, in turn, makes them that much less capable and effective.

Bottom line: Too many people in business and in life fail to learn from their negative

experiences. Even if they’re able to get moving again, chances are they’re going to continue to fail for the same reasons. They make the same mistakes because of their biggest mistake—failing to learn from their failures!

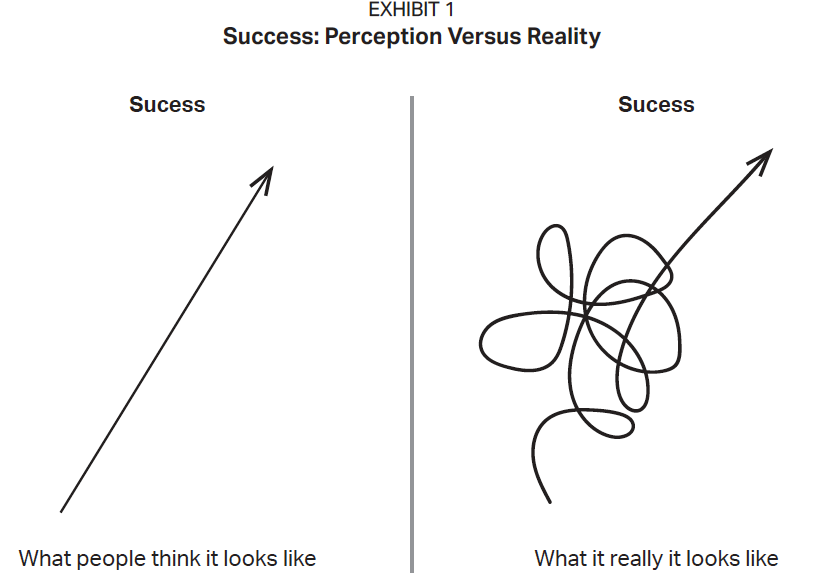

Exhibit 1 shows one of the best ways we’ve seen to think about success and failure. The path is rarely straight and smooth. Failures big and small occur multiple times along the way.

One big pattern we’ve seen is that they make a habit of autopsying their failures—that is,

dissecting them so they can learn from them. Although there is no single correct way to do this, the process in general tends to involve a combination of some or all of the following seven steps:

1.Review your expectations.

Going into each initiative (business, volunteer, investment, etc.), you should have a clearly specified range of expectations. In running the numbers, you put together the financial and strategic possibilities. Here you want to delineate these projections.

2.Detail the results to date.

There are different degrees of failure. Hence, you need to precisely describe the current state of affairs and where you see things going.

3.Identify the discrepancies.

It’s important to quantify (where possible) and highlight everywhere you can the differences between what you expected and what happened.

4.Compile a list of all the “mistakes.”

Put together a list of all the errors that resulted in each discrepancy—without attributing blame or responsibility. Very often the best way to do this is to construct a matrix. The reason: Many of the same mistakes, such as depending on the wrong person, tend to produce multiple discrepancies.

5.Specify the lessons you need to learn.

By carefully considering the causes of the discrepancies, you’re likely to see singular errors in judgment as well as patterns of miscalculations. From these, you need to tease out the lessons so you don’t repeat the same mistakes next time.

6.Aggregate the mistakes from a number of failed initiatives or poor investments

(if applicable).

You may not see a pattern of miscalculations by autopsying just one failure. Only by considering a number of unsuccessful ventures will the decisive mistake become evident.

7. Learn the bigger lesson.

Across multiple unsuccessful initiatives, you can determine ways of thinking, habitual actions and repeated poor judgments. From here you can discern the bigger lessons you need to master in order to ensure you only make new

mistakes—not the same old errors of the past.

Three guidelines to better learn from your mistakes

All that said, let’s not kid ourselves: Autopsying failed endeavors can be quite a stressful and arduous process. After all, the process is about admitting that you messed up and then essentially reliving those errors repeatedly—complete with all the aggravation and strain, multiplied by knowing the ending. It’s about highlighting your weaknesses while discounting your strengths.

But if you autopsy well and learn the lessons the process provides, you can achieve considerably greater success down the line.

With that in mind, here are three guidelines for making your failure autopsy process more impactful.

Guideline #1: Take your time

The personal pain of reliving failures tends to make people want to rush through it all. By going quickly, however, you risk being sloppy and missing key elements that reveal the genesis and true consequences of the poor decisions that were made.

When self-made billionaires dissect their failures, they actually tend to go at it with some enthusiasm. They’re actively looking for ways to improve their strategies and approaches as well as their selection of and dealings with others. So they move deliberately and methodically.

Wealth creation implication: Take each step carefully to ensure that you cover all the ground you can. Look at your errors from a number of perspectives. Make sure when you identify a lesson that it’s the right lesson you need to learn.

Guideline #2: Be extra critical.

Some self-made billionaires have provided us with detailed examples of their significant business miscalculations and how they conducted post hoc evaluations of their actions. What we always noticed was that they were not nice to themselves. On the contrary, they were often quite brutal—but constructively so.

Wealth creation implication: You need to be appropriately hard on yourself. Unless you’re brutally honest, you’re not going to be able to identify the lessons you need to learn. Subsequently, you’re not going to be able to profit from your mistakes.

Guideline #3: No pain, no gain.

Creating a sizable personal fortune is not easy. You’re likely going to take more than a few body blows along the way—and they’re going to hurt. The most successful people we know move forward and are better because of their failures and the hurt. In fact, it’s often the pain that stays with them most—inspiring them not to make the same mistakes a second time.

Wealth creation implication: The idea is not to avoid the pain but to use it to learn lessons that will make you wealthier.

Don’t underestimate your role

Finally, take a philosophical step back, look in the mirror and tell your reflection that your failed negotiation was Entirely. Your. Fault.

Just be sure to have a smile on your face when you do this.

That’s because autopsying failure is not about being self-sabotaging. Instead, it’s about being honest with yourself and moving forward with greater insight from the lessons learned. And the best way to profit from your failures is to admit that they’re your failures.

Let’s say you own a business or manage a large division of people. The collapse of a business venture you oversaw could be directly attributed to another person who was running the day-to-day operations. It’s still your fault. You failed to accurately identify the weaknesses in that individual and see the possible complications that could lead to failure.

After a good professional failure autopsy, you’ll have identified the factors that ultimately proved to be disastrous. That, in turn, will give you a better understanding of how to judge people going forward—as well as how to mitigate their impact on your personal wealth when they hit the wall.

In a nutshell, the only person who’s likely to make you extremely rich is you. Good or bad, success or failure—the buck must always stop with you. So don’t shy away from your mistakes or put on rose-colored glasses when you make a big error. Dissect the situation carefully and methodically—and next time, you just might find yourself in the winner’s circle.

0 Comments